- Dbs Time Deposit Interest Rate Singapore

- Dbs Time Deposit Promotion

- Which Bank Is Best For Time Deposit

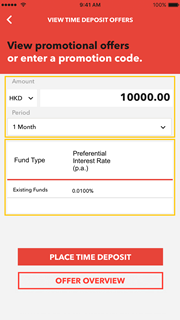

Time Deposit: Time Deposit Opening-Time Deposit Maturity Instruction Change-= Online Enquiry Function = A 'Transaction Reference No.' Will be provided for each. Time Deposit Account 27-28 F. Regular Savings Plan 29 G. Automatic Fund Flow Service (For DBS Treasures only) 30 H. Securities Account (For Packaged Account only) 31 I. Wealth Management Account (For DBS Treasures only) 32 PART III – LOAN SERVICES RE LATED TERMS AND CONDITIONS J. Secured Loan Facilities 33-39.

DBS meets your banking needs with a wide range of bank accounts from high interest savings accounts to current and Fixed Deposit accounts! DBS Time Deposit DBS Singapore offers fixed deposits in both foreign currency and Singapore dollars with a minimum deposit of S$1,000 and a deposit tenor of 1 month and above. DBS Time Deposit Interest Rates. My preferred fixed deposits below is DBS and Maybank iSAVvy Time Deposit. DBS Fixed Deposit. Interest Rate: Refer below, Minimum Placement: S$1,000, Promotion Valid Until: Not stated. Based on the interests rates published on 4th May 2020, the rates remained unchanged. For a minimum amount of S$1,000, you can perform a fixed deposit placement.

Looking for the best fixed deposits in Singapore? There are varying fixed deposit promotions in terms of interest rates, tenure period offered by the banks in June 2020.

The 1 year interest rate for July 2020 Singapore Savings Bonds has fallen as low as 0.30%, thus any of the fixed deposits promotion below will beat the Singapore Savings Bonds.

I have shared many other financial instruments that is similar to what fixed deposits can offer. They are endowment plans such as Tiq 3 Year Endowment Plan and China Taiping i-Save Plan. The benefit of these endowment plans is the guaranteed capital upon maturity which is similar to what fixed deposits offer.

Last month, I have signed up for a Singlife account, which is an insurance savings plan that offers you 2.5% p.a. for up to S$10,000. The interests paid last month was S$18.72 based on a deposit of S$10,000.

The current low interest rates offered by most banks remained unattractive to me. Nevertheless, if you still prefer traditional fixed deposits, below are the best fixed deposits promotion that I have found for June 2020. My preferred fixed deposits below is DBS and Maybank iSAVvy Time Deposit.

DBS Fixed Deposit

Interest Rate: Refer below, Minimum Placement: S$1,000, Promotion Valid Until: Not stated

Based on the interests rates published on 4th May 2020, the rates remained unchanged.

For a minimum amount of S$1,000, you can perform a fixed deposit placement with DBS. For a 12 months placement of S$10,000 at 1.40% p.a., the interest that you will receive upon maturity is S$140.

Dbs Time Deposit Interest Rate Singapore

MayBank iSAVvy Time Deposit

Interest Rate: 1.20% (12 months) or 1.40% (24 months), Minimum Placement: S$25,000, Promotion Valid Until: Not stated

I found some changes to the time deposit offered by MayBank. It seems that MayBank had decided to do away with their traditional time deposit and replace with the iSAVvy Time Deposit.

This promotion is valid from 17th April 2020 onwards for a minimum placement amount of S$25,000 in iSAVvy Time Deposit via Maybank Mobile/Online Banking (for individuals only).

For a 12 months placement of S$25,000 at 1.20% p.a., the interest that you will receive upon maturity is S$300.

For a 24 months placement of S$25,000 at 1.40% p.a., the interest that you will receive upon maturity is S$704.90.

Hong Leong Finance Deposit Promotion

Interest Rate: Up to 0.95%, Minimum Placement: S$20,000, Promotion Valid Until: Not stated

Dbs Time Deposit Promotion

For 10 months placement of S$20,000 at 0.90% p.a., the interest that you will receive upon maturity is S$150.00.

| Deposit Amount | 6 month | 10 month |

| S$20,000 to < S$100,000 | 0.55% | 0.90% |

| S$100,000 and above | 0.60% | 0.95% |

UOB Time Deposit

Interest Rate: 0.90%, Minimum Placement: S$20,000, Promotion Valid Until: 30th June 2020

For 10 months placement of S$20,000 at 0.90% p.a., the interest that you will receive upon maturity is S$150.00.

| Minimum Placement (Fresh Funds) | Tenor | Promotional Rate |

| S$20,000 | 10 month | 0.90% p.a. |

OCBC Time Deposit

Interest Rate: 0.85%, Minimum Placement: S$5,000, Promotion Valid Until: 30th June 2020

| Minimum Placement (Fresh Funds) | Tenor | Promotional Rate |

| S$5,000 | 12 month | 0.85% p.a. |

For 12 months placement of S$5,000 at 0.85% p.a., the interest that you will receive upon maturity is S$42.50.

Standard Chartered Bank Singapore Dollar Time Deposit

Interest Rate: 0.40% to 0.50%, Minimum Placement: S$25,000, Promotion Valid Until: 8th June 2020

For 6 months placement of S$25,000 at 0.40% p.a., the interest that you will receive upon maturity is S$50.

If you happen to be a priority banking customer, for 6 months placement of S$25,000 at 0.50% p.a., the interest that you will receive upon maturity is S$62.50.

Which Bank Is Best For Time Deposit

| Minimum Placement | Tenure | Promotional Rate | Priority Banking Preferential Rate |

| S$25,000 | 6 months | 0.40% p.a. | 0.50% p.a. |